The post-pandemic legal bubble is under pressure – and it’s showing. Latest LexisNexis research predicts slowing growth for 2024 legal market

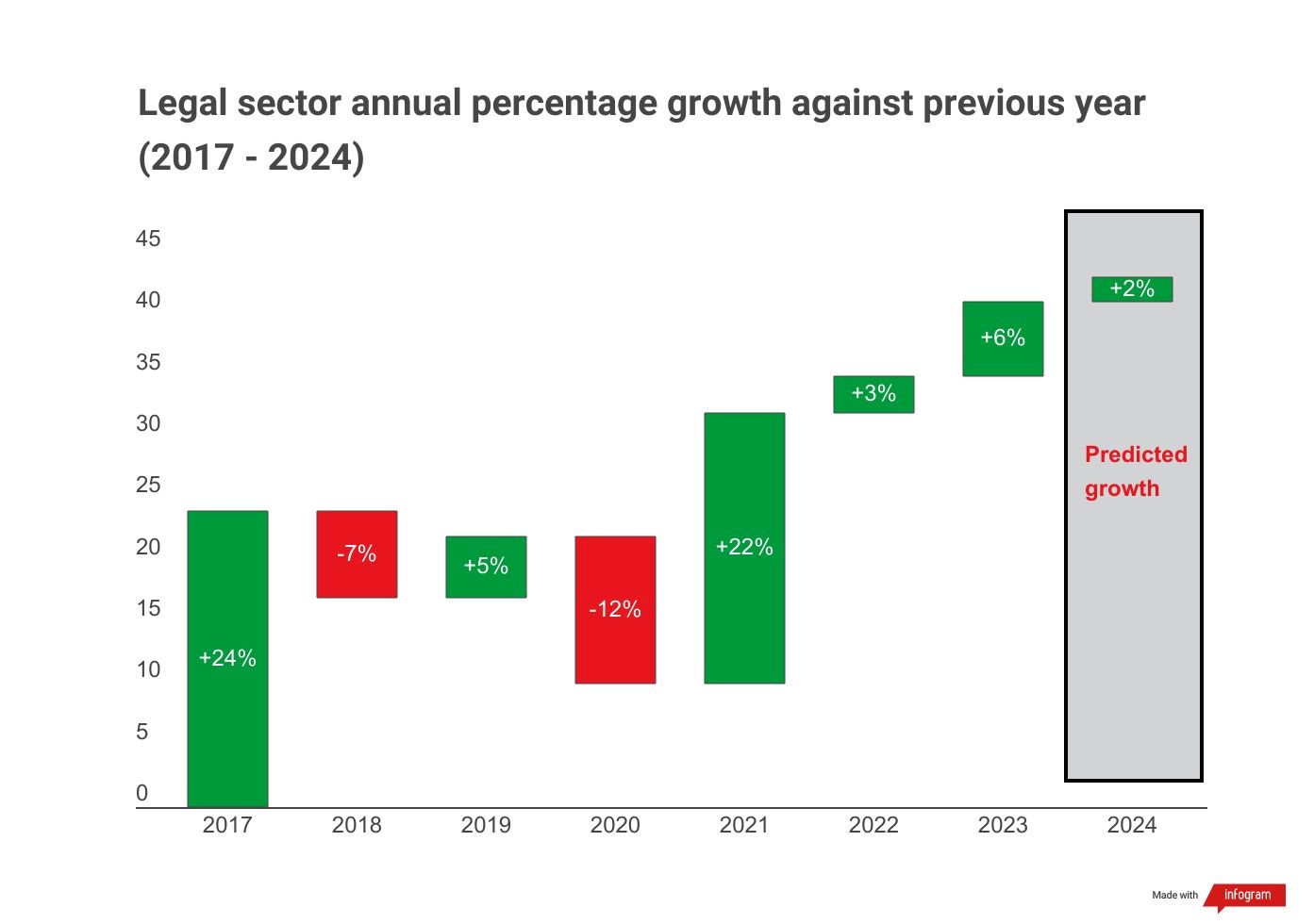

Market challenges might finally be hitting the seemingly resilient legal sector. The latest GLP Index predicts growth will drop to only +2% in 2024 from 2023’s +6% growth.

Today, LexisNexis Legal & Professional, a leading global provider of legal information and analytics, has released the latest “Gross Legal Product (GLP) Index”. This report predicts that the legal sector will grow by +2% in 2024 – suggesting that its growth trajectory is slowing.

Despite exceptionally challenging market conditions over the past three years, the Index revealed that legal demand grew by +22% in 2021, +3% in 2022 and is expected to grow by +6% in 2023.

However, the latest edition of the GLP Index, which pulls historic data from hundreds of sources to predict future demand across the legal market, reveals market challenges may finally be catching up with the legal sector. These findings align with other recent events in the legal market, such as several high-profile law firms considering redundancies.

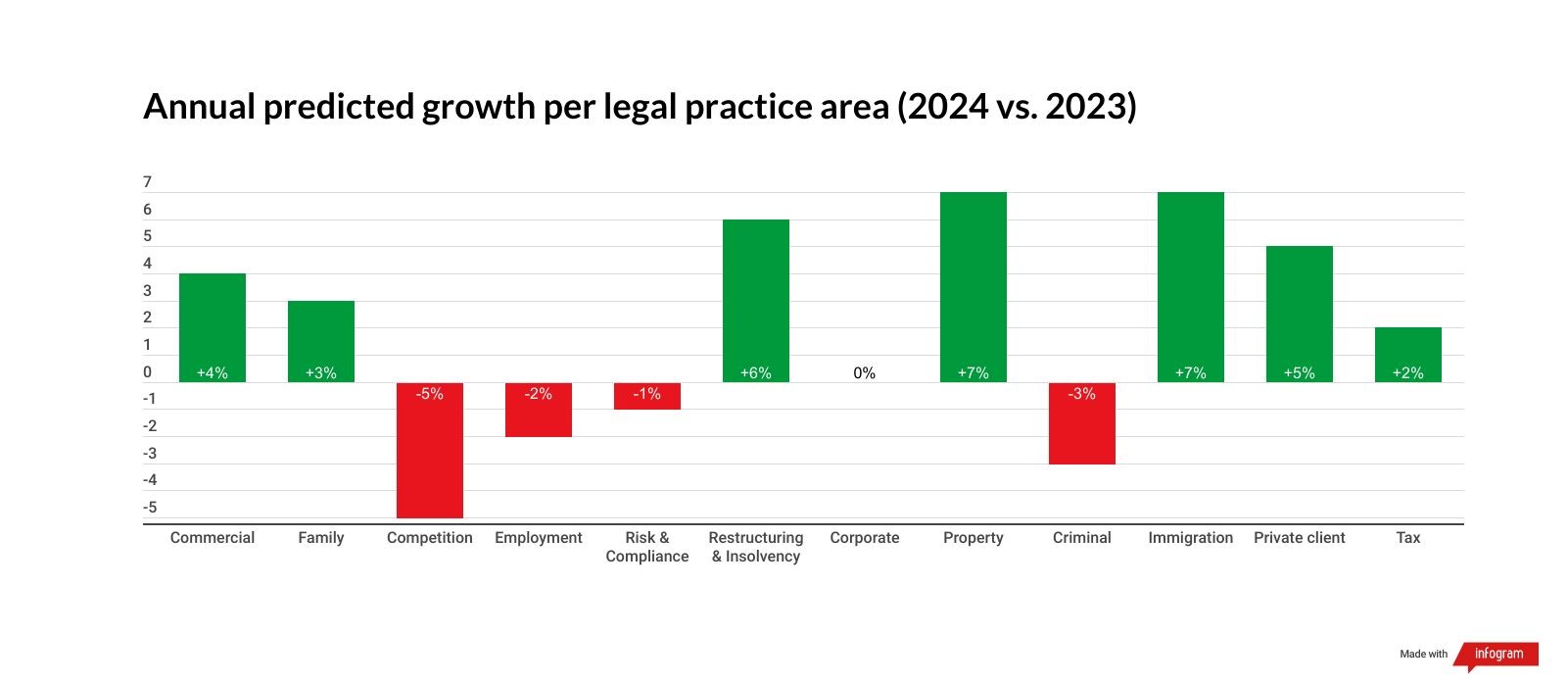

When looking at specific areas of the law, the Index predicts strong growth across property (+7%), immigration (+7%) and restructuring and insolvency law (+6%). Both property and immigration law rebounded in the previous GLP Index after several years of decline. The former has benefited from a record number of newly-completed dwellings (a 9% increase), while the latter has seen the total number of work visas issued almost double, with student visas, settlement applications and citizenship applications also on the rise.

Demand for competition (-5%) and risk and compliance law (+1%), on the other hand, will flatten next year after experiencing steady growth throughout 2022 and 2023. Practice areas that are challenged include criminal law, which is predicted to see negative growth (-3%) for the third year running, and employment law (-2%).

The report’s editor, Dylan Brown, says:

“Considering the geopolitical and macroeconomic headwinds that have battered the professional services industry for the last 18 months, subdued growth is an overwhelmingly positive message to be sharing. Recent growth speaks more to the legal sector’s resilience, ability to innovate when needed, and drive to power forward than it does to its impregnability.”

“Margins are becoming tighter” Brown continues. “So, there is also a very real risk of lawyer burn out as targets increase and the partner track presents greater risk. Firms need to continue investing in infrastructures that support their people rather than work against them.”